Kiwis are not fond of talking about money – so it’s probably not surprising that we’re not great at going and getting financial advice from a professional – we seem to have an almost allergic reaction to just the idea of it.

Plus, when we do go for advice, we don’t seem to be going to quite the right places.

Earlier this year, the FMA released the results of a survey that found that only 11% of Kiwis surveyed went to a financial adviser for help, with 52% preferring to head online, and 32% relying on ads or their friends and family for information.

Meanwhile, young people are turning to social media platforms like TikTok to learn about managing their money. (This is why we think it’s important parents take the time to raise financially independent kids!)

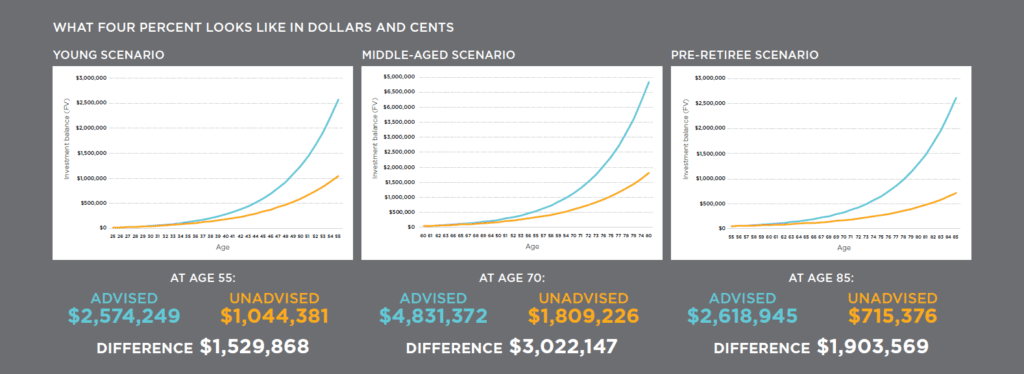

While you may think you’ve had a great investment tip from your neighbour, or feel you know how to best structure your mortgage, research from the FSC shows those who get professional financial advice tend to fare better than those who DIY. For example, those who get professional help see investment returns that are, on average, 4% better, they have 50% more in their KiwiSaver, save 3.7% more of their earnings, and travel more frequently.

The earlier you get started, the better off you’ll be. Here’s what that 4% would look like based on when you started investing.

Kiwis who got financial advice also had more positive outcomes when it came to their mortgages, taking actions that would help them pay off their mortgages faster and make significant savings on interest repayments.

So, what’s stopping Kiwis from getting advice? Well, according to Financial Advice New Zealand it’s not about a lack of trust, but mostly because they don’t feel their circumstances call for advice, or they overestimate their own abilities.

But, as I think we’ve shown above, getting expert financial advice can help anyone be better off financially.

Should I get a financial adviser or a financial coach?

Before we get into the nitty gritty of a financial adviser vs a financial coach, it’s good to keep in mind that for someone to be able to give financial advice they must have a New Zealand Certificate in Financial Services (Level 5). They must also have a Financial Advice Provider (FAP) license or be engaged to operate under a Financial Advice Provider’s license as a financial adviser or a nominated representative and be on the financial service providers register and below to an approved dispute resolution scheme.

Phew, not that we’ve got that out of the way, let’s dig into what a financial adviser does.

A financial adviser gives advice on financial products like KiwiSaver, investment opportunities, mortgages, budgets & saving plans and retirement plans. They can work with you to uncover your financial goals and set up a plan to help you get there.

Some financial advisers will be able to advise you on specific products, like mortgages, investment portfolios etc., while others may be able to advise on a wider range of products depending on their qualifications.

While you’ll be able to find independent financial advisers, you’ll also find those that are attached to specific banks or financial institutions – which means they’ll only be able to advise on the services and products that the organisation provides.

What about a financial coach?

A financial coach does everything above – but also supports you throughout the entire journey and helps keep you accountable. With a coach, the creation of your plan is just the beginning of the journey and they will meet with you regularly throughout the duration of the plan to see how you’re tracking and make any adjustments as required.

They can helps identify ways that you can get ahead faster – through adjusting your cashflow, tweaking your mortgage structure, or accessing investment opportunities.

And what about enable.me coaches?

At enable.me all our financial coaches are certified financial advisers and comply with the New Zealand FMA regulations. So, when you work with them 1-on-1 you know that you’ll be getting expert advice you can trust.

And our coaches like to think of themselves as your personal trainers for your finances – always looking for ways they can train your financial muscles for success.

To achieve this, they:

- Help you understand your money psychology – your money personality, mindset and tendencies tend to influence how you’re managing your finances, more so than how financially literate you are.

- Design plans that unlock your financial potential. An enable.me coach will consider your starting point, your goals, capability, capacity to improve, your opportunities and obstacles, and of course your money psychology to design a plan that will work for you.

- They will keep you accountable, measure results and track how you’re progressing towards your goal. They’ll make adjustments to keep you on track.

- They are your lifetime financial partners. They can take you from reducing debt or buying your first home, to supporting you with your investments, right through to retirement and beyond.

- They partner with specialist service providers – like investment property, investment, and mortgage experts – so you can get the best outcomes no matter your goal.

- They cheer on your successes – but they also motivate, encourage and have those honest conversations.

- And, we don’t use assumptions. We deal with real data so we can make better decisions and get really specific about what’s required to achieve your outcomes, and make adjustments as required.

At enable.me we offer more than just advice. We help you implement strategies that get you financially fit, grow your wealth, and achieve your financial goals. We offer personalised coaching throughout your financial journey to hold you accountable and help you execute your plan.

To meet an enable.me financial coach to discover out what you’re capable of and come up with a dynamic plan that suits your financial goals to a ‘T’, book your initial consultation today. (A fee applies).

Disclaimer: This blog post is for informational purposes only and does not constitute individual financial advice. If you’re interested in receiving personalised financial advice, you can book in a consultation with an enable.me coach. Costs apply.