With a lot happening in the world right now, it can be a challenging time for investors.

You might be wondering whether it’s the right time to leave your investments where they are or if it is time to move them into a lower-risk option, such as a term deposit. While the risks can’t be ignored, it is essential to understand the reasons for making a change before you act.

So, we thought we’d tackle some common concerns when it comes to investing and, in the process, remind you of some essentials when it comes to investing.

1. Investing is a long-term game

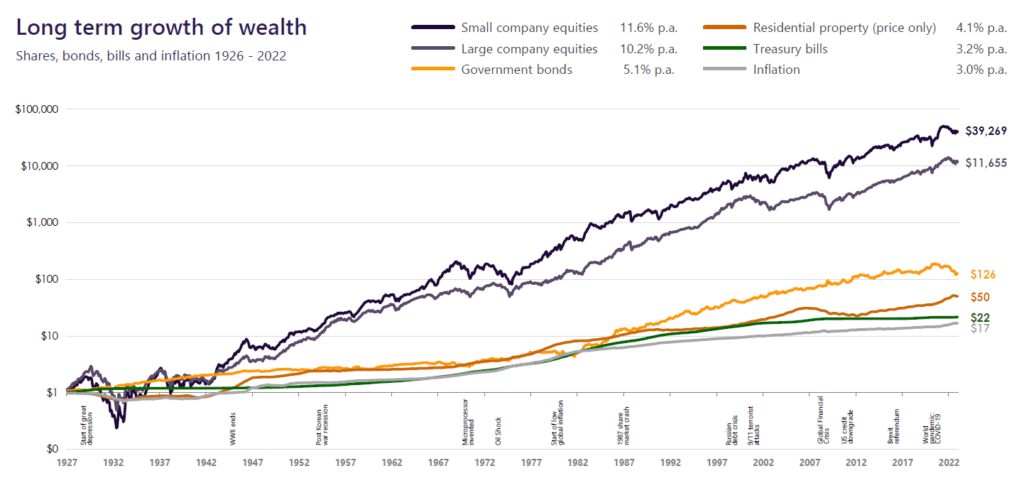

When investments fall in price, it’s natural to want to sell it all and opt for the familiarity of a savings account or term deposit. But investing is a long-term strategy, and it is almost inevitable that there will be bumps in the economic road along the way – the important thing is to build a strategy that aligns with your objectives, risk appetite, time horizons and your personal circumstances. If we look back at historical data, times of turmoil (think the Great Depression and GFC) have eventually followed with a recovery in share markets and continued to grow over time. So, there are many reasons to remain optimistic about investing.

Source: SBBI (Stocks, Bonds, Bills and Inflation January 1926 – December 2022) to end Dec 2022

This graph shows the historic returns of investing over the long term.

2. Switching to a Term Deposit won’t solve the problem

Right now, we’re seeing a trend of Term Deposits offering better returns than many managed funds. It’s understandable that you may be tempted to switch. But these higher rates often don’t last and there is a risk that switching mid-market may negatively impact your returns over the long term, because you miss the recovery. Unless you need your money in the short-term, switching to a term deposit may not be the best idea.

So before pulling the pin on your investments, understand the reason you want to switch, and consider seeking independent financial advice to get a clear understanding of the potential risks involved with that.

3. Humans feel loss twice as strongly as they do a win

The nature of investing means there will be losses and wins. The tendency is to give more weight and focus on the losses and not the growth that happens in the good times. Like anything, you need to look at your funds’ performance over time, not just at a moment in time.

We’re often tempted to lean towards a conservative approach to investing as a result of what we call ‘Loss Aversion’. The idea is that experiencing a loss is psychologically twice as painful as the pleasure of experiencing a win. So, before making the change, understand what you want to achieve. Are you trying to avoid the pain of further losses at that time? Or is it genuinely in the best interest of your financial goals?

4. Nothing sells better than doom & gloom

With so much access to news and financial opinion, there is nothing more newsworthy than a crisis. So, be aware of media bias. It is easy to get drawn in by the media talking about recessions, crisis, and crashes. The danger is you can make a snap decision without all the information relevant to your situation and circumstances.

So, when is the right time to make a change?

With all things considered, you may still feel that it is time to make a change to your portfolio. Here are some reasons why it might be time to change:

- Your investment time frame has shortened.

- Your personal circumstances have changed.

- Your values about what you are investing in have changed.

That is where we are here to help. The benefits of working with the team of financial coach at enable.me means we can help you assess the best options for your circumstances and build a strategy that is right for you. And thereon, we’re just a phone call away.

Click here to find out why having a financial coach on side to help advise on your investment portfolio is the best decision you could make – especially in these volatile times. Fees apply.

Disclaimer: This blog is for informational purposes only and does not constitute individual financial advice.