‘Are Kiwis recession ready?’ This was the question posed by the Financial Service Council when they released their annual Financial Resilience Index last month. And while Treasury no longer thinks we’re headed into a recession later this year, that doesn’t mean we’re out of the woods quite yet.

Inflation is still higher than it’s supposed to be, and the Official Cash Rate (OCR) will probably stay up at 5.5% well into 2024, meaning that Kiwis – recession or not – will still experience some of the pressures that come with an economic downturn.

But if you’re one of the 50% of Kiwis worrying about your finances on a daily or weekly basis – there are still reasons to be positive, and there are ways to minimise the impact that economic pressure might be having on your financial progress.

But first…

… what is an economic downturn anyway?

An economic downturn is a period when the economy isn’t doing so great and experiences a decline in its overall performance. During this time things like production, employment and spending tend to decline – in essence, people are spending less, and companies are making less money causing the economy to slow down.

The important thing to know is that economic downturns are a natural part of the economic cycle. And after a downturn, the economy will start to experience growth again.

However, going through a downturn can still be challenging, affecting your finances and slowing down your financial progress.

How can you ease the pressure of a downturn on our finances?

You’re likely to hear of impending economic doom before you start feeling it in your back pocket. And some of the headlines you encounter in the newspaper can be scarier than what you’ll experience.

So, start by understanding how you could be impacted financially and if what the headlines are saying will affect your situation.

Falling house prices don’t matter if you don’t need to sell and can sustain your mortgage payments. Likewise, with a fall in share prices, if you’re not needing to liquidate them anytime soon. Just sit tight, ride it out, and wait for it all to recover.

Rising interest rates don’t matter if you don’t have to re-fix your mortgage. And if you have plenty of cash left over at the end of your pay period, then inflation is less likely to significantly impact your cash flow and ability to make progress.

But if you do find that your financial situation is going to feel some pressure, here are some initial actions you can take:

- Sort your financial buffer. This is about 3-6 months of your salary that will allow you to maintain your lifestyle in the event you lose your salary.

- Assess possible scenarios. If your mortgage is coming up for renewal, for example, and you’re jumping from 2.5% to well into 6%, use an online tool to calculate what your new repayments will be and how that impacts your cash surplus.

- Then improve your cash flow management. Track your expenses and identify areas where you may be overspending or overpaying. A common area for overspending is food and utilities. Shopping around for a better deal can be worth the effort if it saves you in the long term.

- Revisit your mortgage strategy. Can you refinance or restructure your mortgage to reduce how much you must pay back to the bank, but gives you the flexibility to pay back more when you’re able?

- Put your savings to work. Even with the higher interest rates that banks are offering on savings accounts, the money you earn in interest is still less than inflation and likely less than the interest you’re paying towards any debt you have (including your mortgage debt). See if you can redirect those savings towards paying off your debt or look at investing.

- Harness the power of accountability. It’s easy to get lulled into inaction when we’re unsure what opportunities there might be out there for us or to press pause on financial progress when we’re unsure we’ll be able to achieve what we’ve set out to. When you have someone, like a financial adviser who knows what you’re capable of watching over your shoulder, you have their expectations to live up to as well as your own.

What about things you shouldn’t do?

Panic. And make financial decisions based on emotions.

When we panic, our logical thinking may be compromised, resulting in choices that could hinder our financial future. A stark example is moving your KiwiSaver investment into a lower-risk (and lower-returning) fund when we don’t need to. This will likely result in locking in any losses you’ve experienced and missing out on returns when the markets recover.

Locking in high-interest rates for a longer fixed term on your home loan could also harm your long-term goals. While tempting to get the best rate today, you might end up paying these higher interest rates for longer than you need to (and breaking a fixed-term mortgage in a falling interest rate environment could cost you a lot of money).

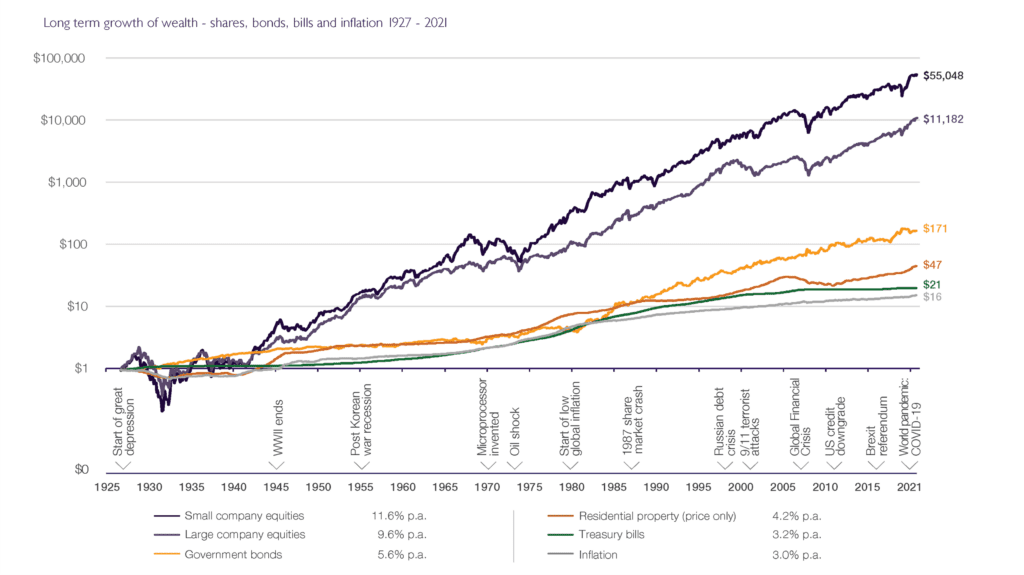

Lastly, one of the biggest things that could hinder your financial future is putting your financial plan on hold altogether – as doing nothing could actually cost you more in the long run. History has shown that downturns or recessions are followed by periods of recovery and this time is unlikely to be any different. While it can feel uncomfortable now, this won’t last forever and it’s worth plugging through now to reap the benefits of that recovery.

The graph below shows that economies have made it through some of the most challenging dips in history.

Finally, make a commitment to maintaining your momentum.

As tempting as it is to hit pause and wait for economic conditions to turn in your favour, make the commitment to maintaining the momentum of your financial progress.

Often, what holds us back isn’t necessarily the economic conditions themselves, but rather the lack of a financial plan, the lack of a clear goal that you’re working towards, or the lack of knowing what actions you can take today to keep you on track to reaching that goal.

If you’re interested to find out what opportunities there are for you to maintain your momentum (or even accelerate your financial progress) now, book a consultation to chat with an enable.me financial adviser today. They’ll be able to take stock of your current financial situation, identify the actions you can take today and lay out a financial plan that will see you weather any financial storm. This consultation is valued at $400 but will cost you just $249. Click here to get started.

Disclaimer:

This blog post is for informational purposes only and does not constitute individual financial advice. If you’re interested in receiving financial advice, you can book a consultation with an enable.me coach. Costs apply.